FX Ecosystem 04 | Robust and resilient: FX in times of poly (crisis) | ShapingFX series

CLS, which runs the settlement engine for the foreign exchange (FX) market, processes around USD6.5 trillion of payment instructions every day. Since its creation in 2002, CLS has successfully served its main purpose of mitigating

FX settlement risk in the market, providing reliable business as usual service even during unusual times. This paper looks under the hood of the CLS engine, with a particular focus on operations during market turbulence.

18 business days, 5-hour operations, zero balances

The CLS operating model is unique in its design. CLSSettlement is a multicurrency settlement system that supports 18 currencies.1 For payments to and from CLS, it draws on the RTGS (real-time gross settlement) systems of the corresponding central banks in the respective jurisdictions.2

The CLSSettlement system spans multiple time zones, and it operates over a five-hour window (07:00 to 12:00 CET) during which the 18 RTGS systems have overlapping processing hours.3 4

By design, CLS therefore runs 18 business days in less than half a day, with the actual settlement phase de facto requiring less than two hours (i.e., finishing before 09:00 CET). Participants inject money ahead of and during the settlement session, and all funds are re-distributed by the end of the session (figure 1).5 Consequently, account balances in CLS revert to zero at the end of the business day, and CLS does

not hold overnight balances.6

The sum of the daily payment instructions in CLSSettlement totals approximately USD6.5 trillion. However, the actual liquidity that needs to be mobilized via the RTGS systems is only a fraction of this amount. Multilateral netting and additional optimization tools reduce funding needs by around

99%, so only around USD65 billion of liquidity is actually required for a successful settlement day.7

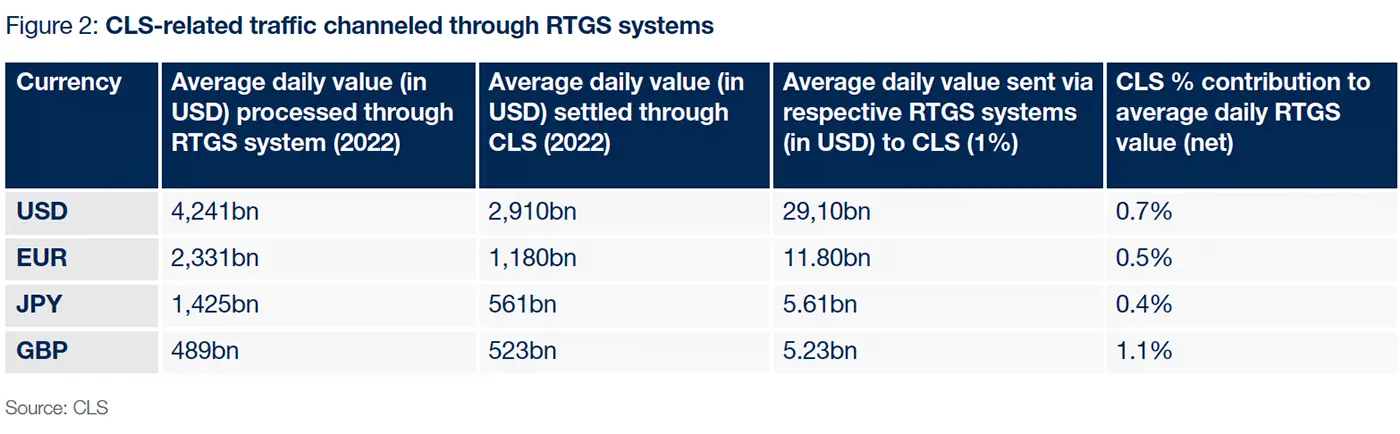

The hugely positive impact of CLS’s liquidity optimization on the FX ecosystem is reflected in the CLS-related traffic channeled through the 18 RTGS systems. The share of CLS-related business in one currency represents around 0.5% to 1% of the domestic RTGS system’s overall traffic (figure 2).8

If there were no netting and CLS transaction values had to be mobilized on a gross basis, CLS-related business would substantially increase RTGS system traffic, in some cases even doubling the RTGS system processing values.9

1The 18 CLS-eligible currencies are: AUD, CAD, CHF, DKK, EUR, GBP, HKD, HUF, ILS, JPY, KRW, MXN, NOK, NZD, SEK, SGD, USD and ZAR.2See also BIS (2008). How CLS works – a simplified example, Quarterly Review September

3For details, see Shaping FX // 01 The FX ecosystem, Taking a central role: Cause and FX.

4Beyond the 5-hour window for CLSSettlement operations, the system also provides a 24-hour trade capture and matching service for the payment instructions on underlying FX trades.

5The ‘maximum value’ shown leaves out the very top 1% in each minute and thus does not reflect unrepresentative outlier days where pay-outs had to be delayed.

6However, in very exceptional circumstances where all pay-outs cannot take place on the day, some accounts may not revert to zero. In such rare cases, CLS may hold an overnight balance. 7For details, see Shaping FX // 03 The FX ecosystem, Liquidity benefits: Do (not) settle for less

8Data taken from Fedwire Funds Service - Annual Statistics (frbservices.org), CHAPS | Bank of England, pboj230731a.pdf (BoJ report 2022), TARGET Annual Report 2022 (europa.eu)

9 For example, the funding submitted to the UK RTGS system (CHAPS) would increase from an equivalent of USD5.23 billion per day to USD523 billion and lead to a doubling of processed values (from USD489 billion to USD1,007 billion).