FX ecosystem 01 | Taking a central role: Cause and FX | ShapingFX series

Change is the only constant, including in the FX world. Since its inception in 2002, CLS has grown and adapted to the needs of the FX market. In mitigating risk and bringing funding and operational efficiencies to market participants, CLS remains the trusted party at the center of the FX ecosystem.

CLS went live in the year 2002 – a time when the internet was creating the ‘global village’,1 smart phones became popular and social media platforms emerged. As society floored the accelerator of change, a public/private partnership forged a financial market infrastructure for FX settlement called CLS. The world has transformed significantly since then, including the FX ecosystem.

The invisible giant: How the FX market evolved over time

The FX market is a global, interdependent and decentralized market for currency trading. It is the world’s largest financial market today, facilitating international trade, hedging and speculation. Over the years, the FX market has grown significantly, currencies from emerging countries have gained ground, and the FX ecosystem has become more complex.

Size

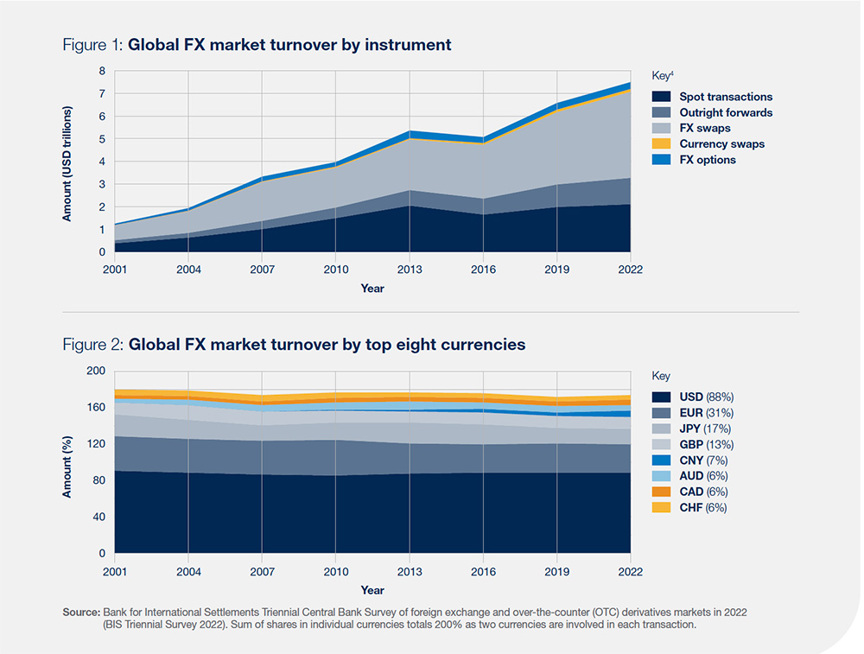

FX market turnover has multiplied by a factor of five over the past two decades, from around USD1.5 trillion to approximately USD7.5 trillion per day (see Figure 1). The FX market is now 30 times greater than global gross domestic product.2

“The statement ‘change is the only constant’ very much applies to the FX market. Since its inception in 2002, CLS has proven to be the robust settlement backbone in a transforming environment.”

Currencies

Throughout its evolution, several key currencies have comprised the bulk of FX trading, dominated by the US dollar, which facilitates offshore funding markets and serves as a base currency via which other currencies are exchanged indirectly.3 The Chinese renminbi’s share of the FX market has grown from 1% twenty years ago to 7% today, making it the fifth most actively traded currency (see Figure 2).

FX ecosystem composition

FX trades are not made on a central exchange, but instead are arranged bilaterally between two counterparties in so-called over-the-counter (OTC) trading. The FX ecosystem comprises major banks that manage liquidity and risk for their clients and themselves (often referred to as brokers/dealers or market makers), other financial institutions (such as asset managers and hedge funds) and non-bank financial institutions (mainly corporates involved in international trade business). Over the past 20 years, the percentage of FX activity of ‘other financial institutions’ has doubled from around 30% to 60%, mainly at the expense of major banks.5 The advent of prime brokerage significantly contributed to this development by enabling hedge funds to reach a wider range of counterparties.6

“Settlement risk can lead to the failure of market participants and trigger a chain reaction that could threaten the stability of the entire financial ecosystem. ”

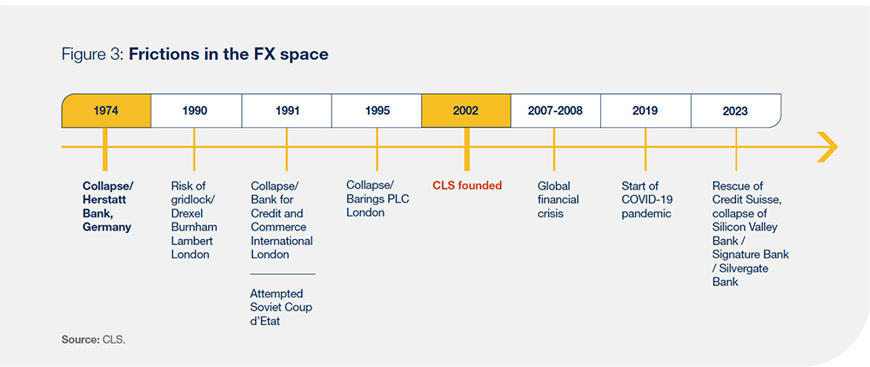

Despite its size, complexity and importance to international trade and finance, the FX market sits in the shade of public consciousness compared to the highly visible equity market. It only comes into the spotlight when its most significant risk materializes – the risk of loss of principal. This risk of an institutional participant paying the currency it sold but not receiving the currency it bought, also called settlement risk, can lead to the failure of market participants and trigger a chain reaction that could threaten the stability of the entire financial ecosystem. Settlement risk could materialize if the settlement of FX trades is not fully synchronized, for example due to time zone differences between the jurisdictions where the two payments are made. This risk materialized in 1974 when Bank Herstatt failed,7and since then, there have been a number of other failures and near misses, notably in the 1990s

(see Figure 3).8

1 In 2002, 8.6% of the world’s population had access to the internet, compared to 68% in 2022 (source: internetworldstats.com)

2 Global GDP is USD96.1 trillion per annum = USD0.26 trillion per day; source: World Bank, World Development Indicators database, July 2022.3 Marontoni, B. (2022) “Revisiting the international role of the US dollar”, Box A, BIS Quarterly Review December 2022.4 Spot transactions are for immediate delivery, which is two business days for most currency pairs. Outright forwards settle for a later date. FX swaps combine a spot transaction with a forward and are a simultaneous purchase and sale of one currency for another with different value dates. Currency swaps involve the exchange of interest (and sometimes of principal) in one currency for the same in another currency. FX options give the right but not the obligation to exchange one currency into another.