FX ecosystem 02 | FX settlement risk: To PvP or not to PvP | ShapingFX series

It is difficult to measure the magnitude of settlement risk in the FX market. Collecting data for further insight from myriad participants in a decentralized global market is no easy endeavor. Moreover, there is no commonly agreed categorization of post-trade settlement practices and their risks. Acknowledging these challenges, this paper1 contributes to the public and private sectors’ ongoing reflections on the extent of FX settlement risk.

Beyond Herstatt: What is FX settlement risk?

FX settlement risk, also referred to as Herstatt risk, is named after the failure of Herstatt Bank in 1974, then the 35th largest bank in Germany. It is remarkable that an event that occurred almost five decades ago at a medium-sized German bank left such an enduring legacy. The Herstatt Bank crisis was a watershed moment for the global regulatory and central bank community that highlighted the need to tackle settlement risk.

At the time, Herstatt Bank had speculated in an environment with high US dollar volatility and accumulated losses that substantially exceeded its own capital.2 When the German regulator closed it down, counterparties incurred losses because the bank had already received payments in Deutsche marks but not yet sent US dollar payments. This is the essence of FX settlement risk: the risk of a bank paying the currency it sold but not receiving the currency it bought.3

While the Herstatt collapse is illustrative4 a variety of factors could trigger FX settlement failure, ranging from counterparty default over operational problems to market liquidity constraints.5

In fact, there are manifold ‘trigger’ events that could lead to the failure of market participants and cause contagion threatening the entire financial ecosystem.6 Ultimately, the lack of synchronization between payment legs of currency trades creates settlement risk which, if realized, can have systemic implications across borders.

Towards payment-versus-payment: How to mitigate FX settlement risk

In the late 1980s and early 1990s, the G10 central bank community conducted several studies on how to address FX settlement risk.7 In 1996, industry groups were encouraged to develop and provide risk-reducing multicurrency services.8 The private sector established CLS in 2002 as a direct response to these public sector clarion calls.

CLSSettlement, the world’s largest multicurrency settlement system, mitigates settlement risk by synchronizing the settlement of payment instructions for the two currency legs of a trade. It does this by providing payment-versus-payment (PvP) functionality in which a party’s payment instruction in one currency is not settled unless the corresponding payment instruction in the counter currency is settled.

Today, the PvP service offered by CLS is considered the de facto market standard for tackling FX settlement risk. PvP’s importance is widely recognized by public and private sector initiatives such as the Basel Committee on Banking Supervision (BCBS), which recommends using PvP settlement where practicable,9 the G20 Roadmap for enhancing Cross-Border Payments, which inter alia aims to facilitate increased adoption of PvP,10 and the FX Global Code.11

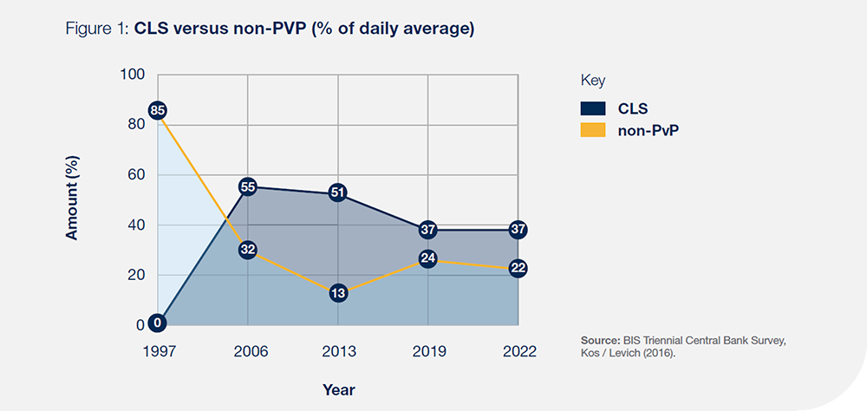

Before CLS was established, the payments for two currency legs underlying an FX trade were predominantly settled by correspondent banks, typically leading to unsynchronized processing chains across different time zones with different banking practices. The reliance on non-PvP settlement has decreased from 85% of FX traffic to 22% over the past 25 years, primarily because of CLS.

The market share of CLS’s PvP settlement service has stabilized at around one third (see Figure 1). This begs the questions how the remaining ca. 40% of FX traffic12 is handled, and why PvP is not used for settling all FX trades.

Today, the PvP service offered by CLS is considered the de facto market standard for tackling FX settlement risk.

1 Read more from our Shaping FX series; cls-group.com/insights/2 In 1974, Herstatt Bank had accumulated 470 million DEM/Deutsche marks (ca. EUR240 million) in losses, compared with capital of only 44 million DEM.3 Settlement risk comprises credit risk (risk of default on a debt that may arise from a borrower failing to make required payments) and liquidity risk (inability to make payments due to a shortage of liquidity arising from a counterparty not settling an obligation when due). The analysis in this paper focuses on a form of credit risk that is realized when one party to a trade gets paid while the other does not. This risk of outright loss of the full value of a transaction is often referred to as principal risk.4 Herstatt Bank was not an isolated case. There have been further failures and near misses in the 1990s. For example: (i) Following the collapse of its parent group, unjustified concerns emerged over the solvency of Drexel Burnham Lambert Trading (DBLT) London. In February 1990, the Bank of England had to make available a settlement facility for DBLT to avoid gridlock. (ii) In July 1991, UK and Japanese FX counterparties incurred losses following the appointment of a liquidator for the Bank for Credit and Commerce International in London. (iii) The attempted Soviet Coup d’Etat in August 1991 led to unwillingness of counterparties to expose themselves to risk in FX contracts with Russian counterparties. (iv) The sudden bankruptcy of Barings PLC London in February 1995 caused settlement issues in ECU clearing (which was a set of arrangements for the multilateral netting and settlement of inter-bank payments in the European Currency Unit, the predecessor of the euro).5 See also BCBS supervisory guidance for managing settlement risk in foreign exchange transactions (2013).6 Notably, in the aftermath of the Herstatt collapse, banks tended to delay payments which in turn created liquidity frictions; see BoE Underground (2015) “BoE archives reveal little known lesson from the 1974 failure of Herstatt Bank”. 7 Bank for International Settlement (1989) “Report on Netting schemes”; BIS (1990) “Report of the Committee on Interbank Netting Schemes of the Central Banks of the Group of Ten countries”; Committee on Payment and Settlement Systems / CPSS (1993) “Central Bank Payment and Settlement Services with Respect to Cross-Border and Multi-Currency Transactions”.8 CPSS (1996) “Settlement Risk in Foreign Exchange Transactions”, CPSS (1998) “Reducing Foreign Exchange Settlement Risk”.9 BCBS (2013) “Supervisory guidance for managing risks associated with the settlement of foreign exchange transactions”; see also letter from BCBS and CPMI Chairs (2020): bis.org/press/201217_letter.pdf10 FSB (2020) “Enhancing Cross—border Payments: Stage 3 roadmap”; FSB (2022) “G20 Roadmap for Enhancing Cross-border Payments: Consolidated progress report for 2022”; FSB (2023) “G20 Roadmap for Enhancing Cross-border Payments - Priority actions for achieving the G20 targets”.11 GFXC (2021) FX Global Code; globalfxc.org/fx_global_code.htm; principles 35 and 50.12 Total traded gross notional.