FX Ecosystem 06 Part 1 | T+1, the FX ecosystem and CLS: What a difference a day makes | ShapingFX series

The global financial landscape is set to undergo significant transformation as the settlement cycle in the securities market shortens from T+2 to T+1. To the extent currencies must be exchanged to fund cross-border securities purchases, the shorter securities settlement cycle will limit the time allowed for the corresponding FX settlement cycle. CLS has been actively engaging with sell- and buy-side clients and industry bodies to better understand the implications of the T+1 shift on the FX community.

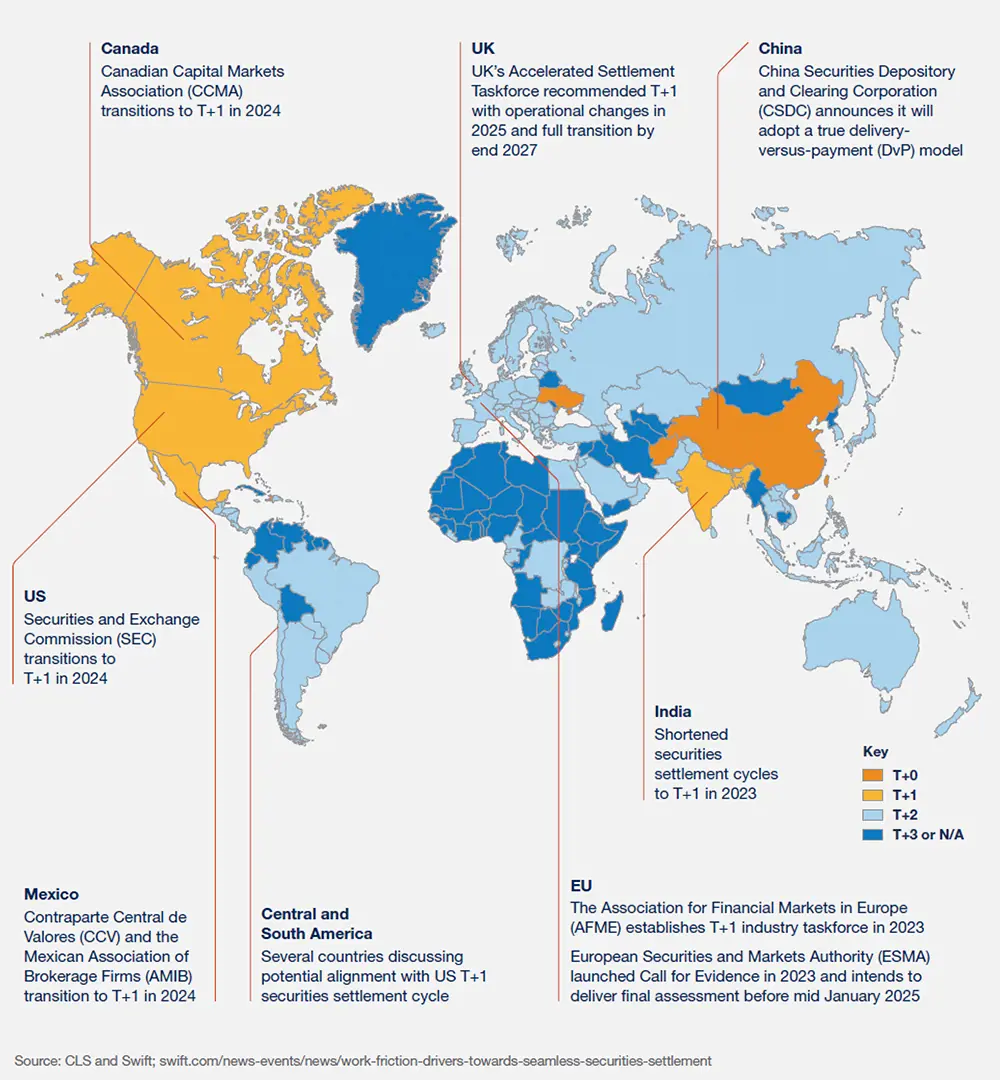

Global momentum toward T+1

Over the past 50 years, securities settlement cycles have shortened substantially, and this trend appears to have accelerated in recent years. When stock exchanges were established over 200 years ago, T+14 was the typical settlement period.

Between the 1970s and 1990s, the settlement cycle shrank to 7, 5 and then 3 days. T+2 became the rule for securities in 2014 for the European Union and in 2017 for the US. The shift towards T+1 is now gaining momentum worldwide (figure 1).