CLSReporting

MiFID II

Support your MiFID II and other regulatory reporting obligations with our end-of-day FX matched instructions report.

Regulation such as MiFID II has introduced a broad range of changes to data and reporting obligations for post-trade transparency. In addition to the public reporting of trades (price and volume), obligations now extend to all financial instruments and asset classes with increased data field requirements.

CLSReporting is an end-of-day FX matched instructions report that provides an enhanced view of your overall FX trade activity. Data required for reporting under MiFID II, such as legal entity identifiers (LEIs) for counterparties and funds, execution timestamps, product identifier (spot, forward or swap) and execution venues, will be available in each report, allowing our clients to address their transactional reporting requirements more effectively. In addition, the report enables originators and counterparties to efficiently exchange their trade details.

Report highlights

- Daily end-of-day FX matched instructions report across CLSSettlement, CLSSameDay, CLSNow, and CLSNet

- Delivered in XML format from Monday to Friday from 22:00 CET

- Report consolidates the previously offered CLS Unique SWAP Identifier (USI) / Unique Transaction Identifier (UTI) reports

- Additional data fields supplied in the settlement instructions by the originator and counterparty to the corresponding FX trade that are matched in the CLS services at the time of production of the report

- Report is easy to import into your warehouse systems using the Settlement Session ID and CLSB Reference keys

Improves

- Post-trade transparency

- Regulatory reporting

- Post-trade analysis

- Operational efficiencies

- Risk and compliance management

- Counterparty control

1.55+ USD trillion

average daily trade volume

Reduces

- Duplicative reporting of trades

- Under-reporting on trade activity

- Effort to resolve data gaps or breaks

- Counterparty risk

Over 50%

access to global FX traded volumes (swap, spot, outright forward), in the market for the 18 currencies CLS settles across 33 currency pairs

Data quality recognition:

- The Value of Volume in Foreign Exchange, by University of Melbourne and Cass Univeristy 2020

Benefits:

- Support MiFID II reporting obligations and more – additional trade data fields enable you to address your FX transactional reporting requirements more effectively

- Improve your counterparty control – the report provides for a more detailed exchange of information with your counterparties for better risk management and oversight

- Integrate seamlessly – standard XML report format allows for easy incorporation into your trade data warehouses and other reporting solutions

- Enhance your view of overall FX trade activity – the additional data supplied will allow you to further your own trade analysis

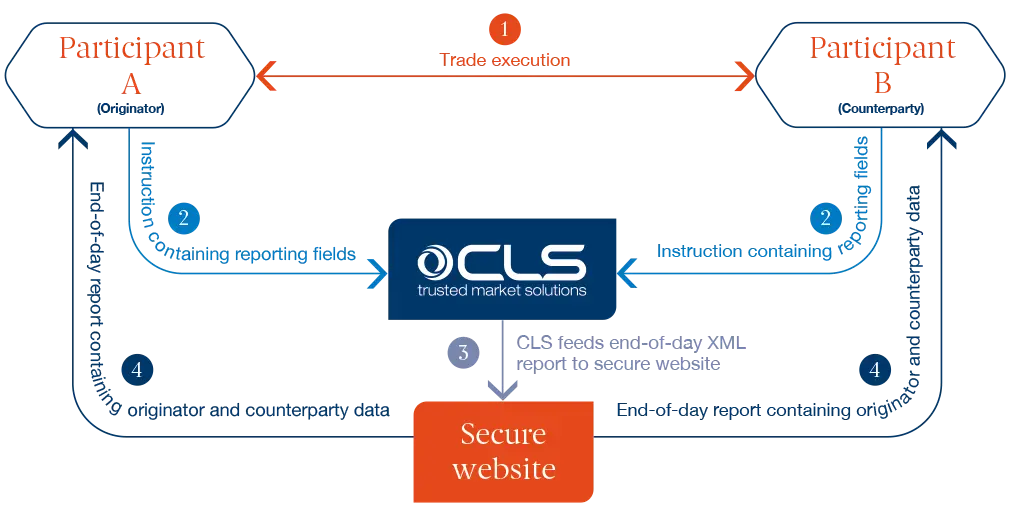

Reporting process flow

How the service works

- Participants on both sides of the trade populate additional SWIFT data fields in FIN/ISO20022 XML message instructions submitted to CLS

- Automatic email notification from CLS when the report is available once subscription is active

- Access the report via a secure HTTPS address for manual download or secure file transfer protocol (SFTP) for automated file download

- Additional data fields supplied in the settlement instructions by the originator and counterparty to the corresponding FX trade that are matched in the CLS services at the time of production of the report

- Opt for an unencrypted or encrypted (PGP) version (recommended) of the report

FX Global code

Using CLS products and services plays an integral part in helping you comply with the FX Global Code.