CLSSettlement

Mitigate settlement risk for your FX trades while benefiting from operational efficiencies, in addition to best-in-class netting and liquidity management. Our world-class payment-versus-payment settlement service delivers huge efficiencies and savings for our clients.

Our FX settlement service is available both directly, to settlement members, and indirectly, to third-party participants. Over 70 of the world’s most important financial institutions chose to be settlement members – and over 35,000 more use our service, including banks, funds, non-bank financial institutions and multinational corporations.

Reduce risk, improve efficiency and increase liquidity

We protect our members and their clients from the most significant risk in the FX market – settlement risk. We do this by simultaneously settling payment instructions relating to FX trades using our unique payment-versus-payment (PvP) system.

We deliver huge efficiencies and savings for our clients, maximizing the advantages of straight-through processing to deliver operational efficiencies and minimize associated costs. In addition, our approach to multilateral netting shrinks funding requirements by over 96% on average, so our clients can put their capital and resources to better use.

Our service is supported by a robust and resilient infrastructure within a comprehensive and well-established legal framework.

We are regulated and supervised by the Board of Governors of the Federal Reserve System and the Federal Reserve Bank of New York. We are also overseen by the CLS Oversight Committee, a co-operative oversight arrangement established by the central banks whose currencies are eligible for CLSSettlement.

70+

settlement members

35,000+

participants around the world use our services indirectly through our settlement members

6.5+ USD Trillion

average settled each day

18

of the most actively traded currencies globally1

1Australian dollar, Canadian dollar, Danish krone, euro, Hong Kong dollar, Hungarian forint, Israeli shekel, Japanese yen, Korean won, Mexican peso, New Zealand dollar, Norwegian krone, Singapore dollar, South African rand, Swedish krona, Swiss franc, UK pound sterling and US dollar.

Awards

- Best Clearing and Settlement Provider 2024 / 2023

- Best Settlement Initiative 2023, FX Markets e-FX 2023

- Best FX Settlement & Risk Mitigation Solution FX Markets Asia 2022 / 2021 / 2020

- Best Trading Infrastructure Provider American Financial Technology 2021

Benefits:

- Systemically important financial market infrastructure critical to the orderly functioning of the global FX market

- Risk mitigation and management

- Capital and liquidity efficiencies

- Operational and IT efficiencies

- Business growth opportunities

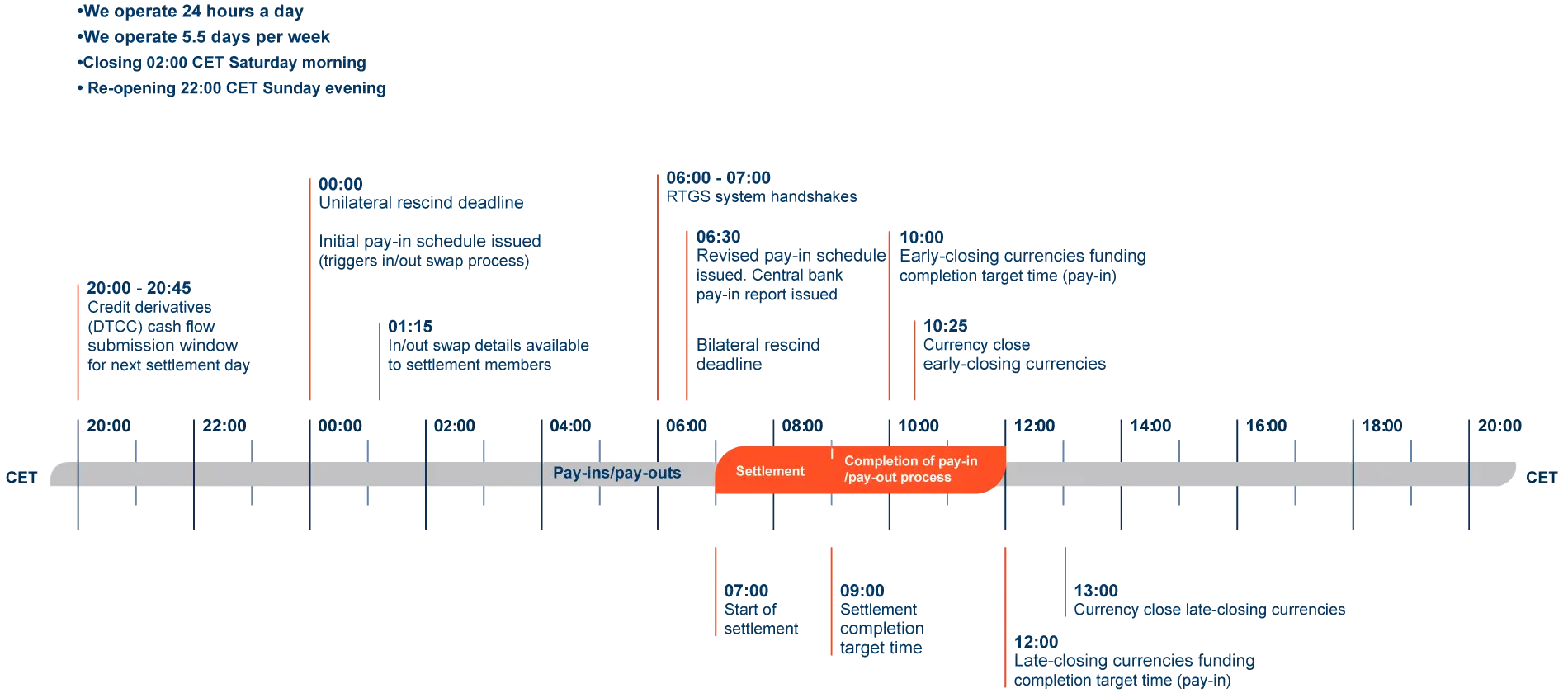

How it works – the settlement cycle

When an FX trade eligible for CLSSettlement is executed by a settlement member or their customers, we receive electronic payment instructions for both sides of the trade. Our system authenticates and matches the information, which provides legal confirmation and stores the information until the agreed settlement date.

On each settlement date, we simultaneously settle each pair of matched payment instructions that satisfy three risk management tests. At the start and end of a normal business day, each settlement member’s multicurrency account has a zero balance. The funding and pay-out of multilateral net positions is conducted using a daily, defined schedule and settlement members pay and receive funds through CLS’s central bank account in each currency via their own accounts or nostro bank accounts.

The settlement of payment instructions and the associated payments across the books of CLS Bank is final and irrevocable. Finality is one of the most important elements of CLSSettlement.

On an average day, we settle over USD6.5 trillion on behalf of our clients. However, the funding required to settle this amount is determined on a multilateral netted basis (where each settlement member only transfers the net amount of its combined payment obligations in each currency), while still settling the gross value of its instructions.

We also offer a liquidity management tool to our settlement members – in/out swaps. This service, combined with multilateral netting, results in an average funding requirement of less than 1% of the total value of all trades for participating settlement members – delivering best-in-class liquidity management.

What is settlement risk?

To settle an FX transaction, counterparties need to exchange principal (value of the trade) in two currencies. Settlement is the risk that one party to an FX transaction delivers the currency it sold, but does not receive the currency it bought from its counterparty. The result is a loss of principal. CLS mitigates this by simultaneously settling the payments on both sides of an FX trade.

CLSSettlement operational timeline

FX Global code

Using CLS products and services plays an integral part in helping you comply with the FX Global Code.