CLSSettlement

Third-party

Mitigate settlement risk for your FX trades while benefiting from operational efficiencies best-in-class netting and liquidity management. Our world-class payment-versus-payment settlement service delivers huge efficiencies and savings for our clients.

Our leading payment-versus-payment (PvP) FX settlement service is available to banks, funds, non-bank financials and multinational corporations through our settlement members which includes over 70 of the world’s most important financial institutions.

Reduce risk, improve efficiency and increase liquidity

Banks, funds, non-bank financial institutions and multinational corporations can gain access to CLSSettlement to settle FX transactions through a CLS settlement member offering CLS-related services to their clients (third-party service providers).

How we mitigate settlement risk

We mitigate settlement risk by simultaneously settling the payments on both sides of an FX trade on a real-time basis. We do this using our unique PvP settlement service which is linked to the real-time gross settlement (RTGS) systems of the 18 currencies eligible for CLSSettlement. The settlement of these payment instructions is final and irrevocable.

The third-party service providers will connect banks, funds, non-bank financial institutions and multinational corporations to CLS, enabling them to submit trades. Third-party service providers are also responsible for handling all of the payment instructions and funding relating to these FX trades.

70+

settlement members

35,000+

participants around the world use our services indirectly through our settlement members

Systemically important financial market infrastructure critical to the orderly functioning of the global FX market

6.5+ USD trillion

average settled each day

18

of the most actively traded currencies globally1

1Australian dollar, Canadian dollar, Danish krone, euro, Hong Kong dollar, Hungarian forint, Israeli shekel, Japanese yen, Korean won, Mexican peso, New Zealand dollar, Norwegian krone, Singapore dollar, South African rand, Swedish krona, Swiss franc, UK pound sterling and US dollar.

Awards

- Best Clearing and Settlement Provider 2024 / 2023

- Best Settlement Initiative 2023, FX Markets e-FX 2023

- Best FX Settlement & Risk Mitigation Solution FX Markets Asia 2022 / 2021 / 2020

- Best Trading Infrastructure Provider American Financial Technology 2021

Benefits:

- Settlement risk mitigation through payment-versus-payment (PvP) settlement leading to:

– Credit efficiencies

– An expanded range of counterparties

– Increased trading opportunities

- Operational risk efficiencies; straight-through processing

- Matching/confirmation of payment instructions on a real-time basis

- The potential benefit for payment netting if offered by the custodian

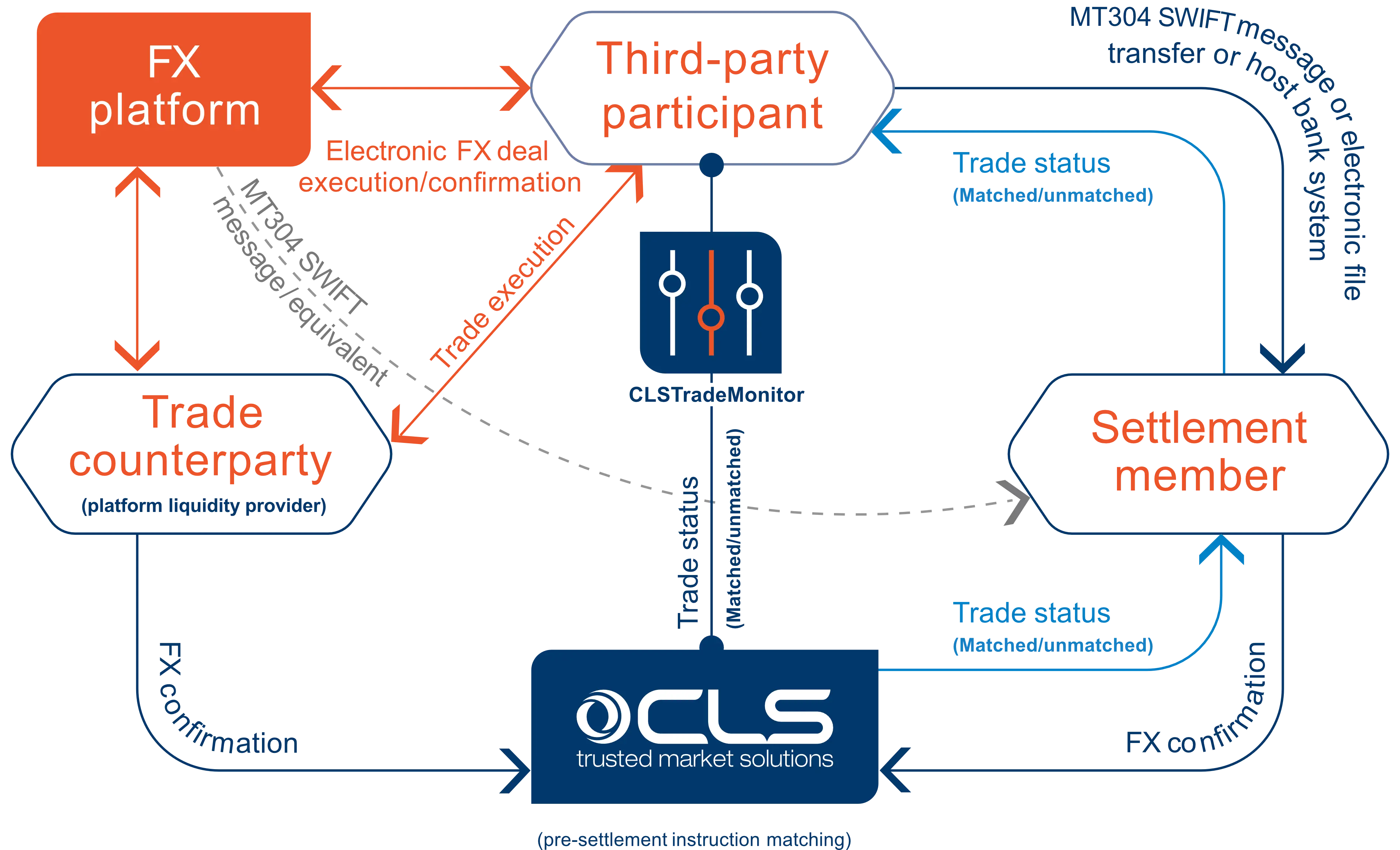

Typical connectivity for CLSSettlement

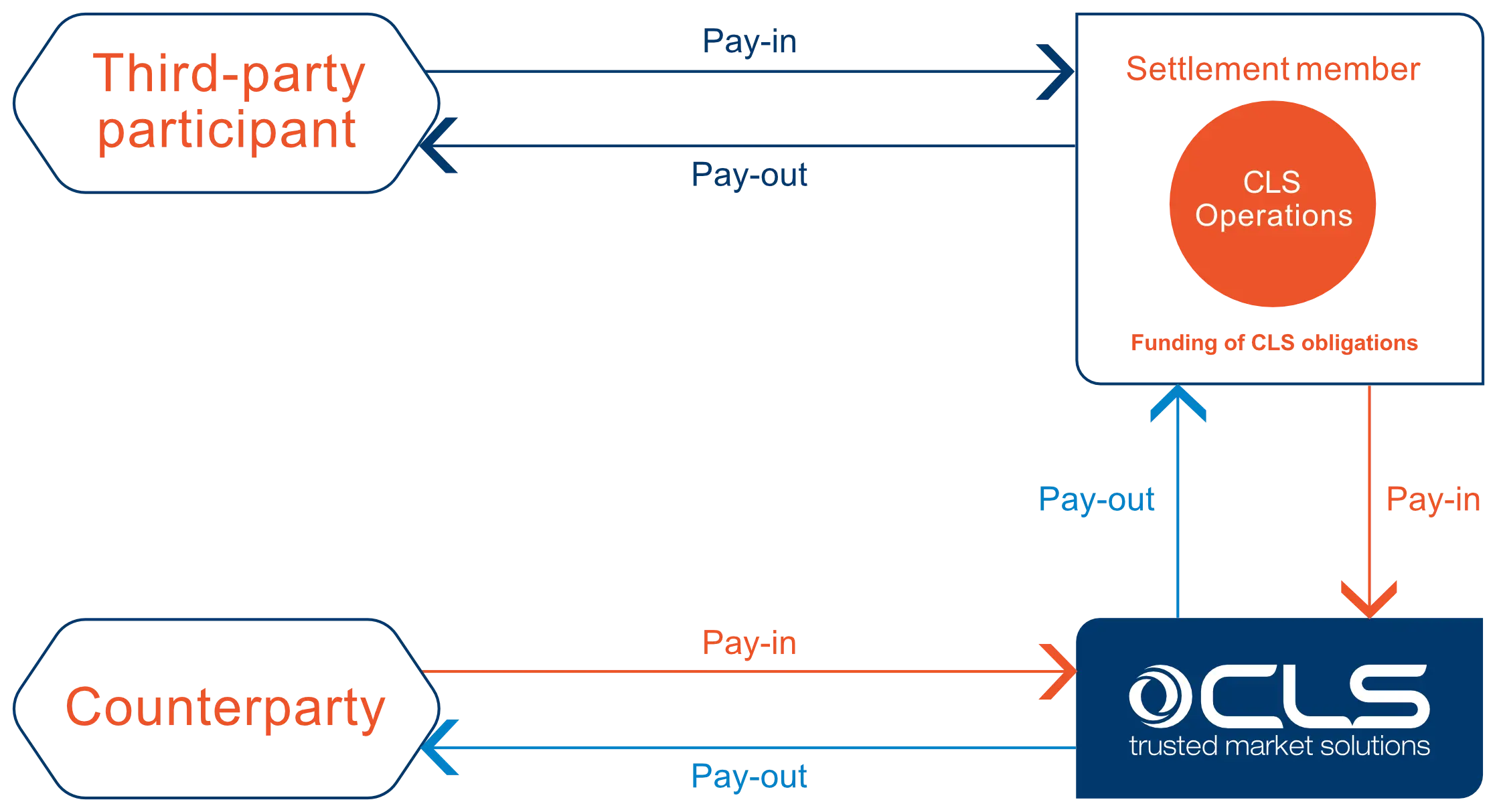

Typical funding flows for CLSSettlement

FX Global code

Using CLS products and services plays an integral part in helping you comply with the FX Global Code.