CLSTradeMonitor

An innovative post-trade monitoring and reporting tool designed for banks, non-bank financial institutions and multinational corporations to efficiently manage executed FX trades through timely, consolidated reporting across all counterparties.

Improving post-trade efficiency in an evolving and fragmented FX market is a priority for market participants leading to a heightened focus on transparency through the trade lifecycle. However, the lack of established and standardized post-trade consolidated reporting tools can increase operational risk and limit visibility.

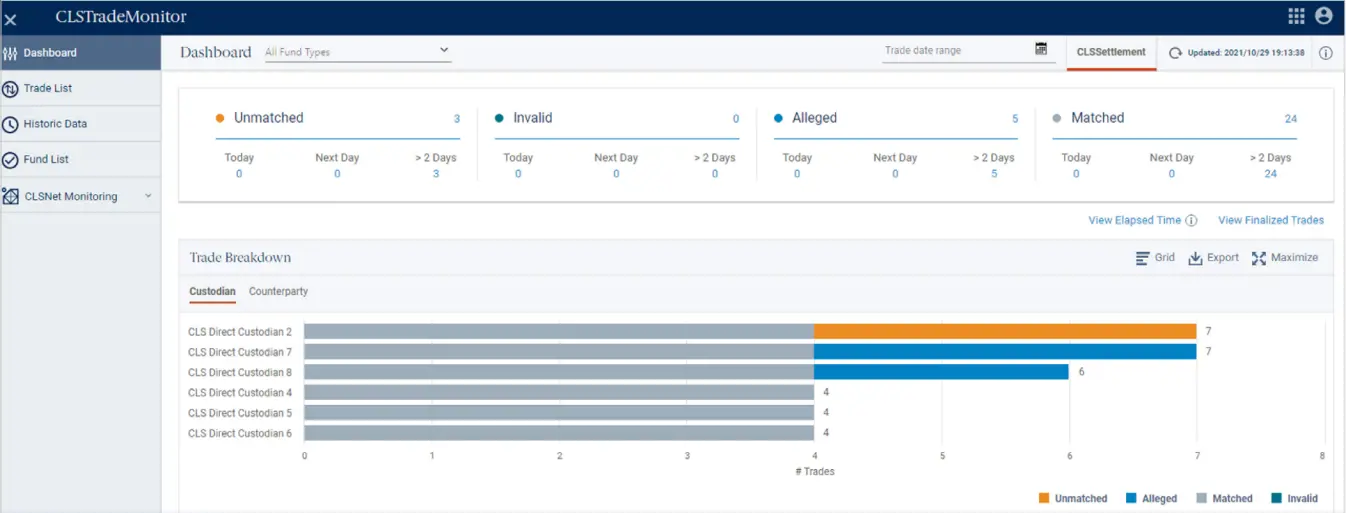

CLSTradeMonitor is a post-trade monitoring and reporting tool that provides a single view of all trade instructions submitted to CLS. Providing enhanced transparency, CLSTradeMonitor is a reliable mechanism to reduce operational risk.

Improves

- Post-trade operational transparency

- Trade exception monitoring

Reduces

- Operational risk

- Process inefficiencies

70+

settlement members

35,000+

participants around the world use our services indirectly through our settlement members

6.5+ USD trillion

average settled each day

Benefits:

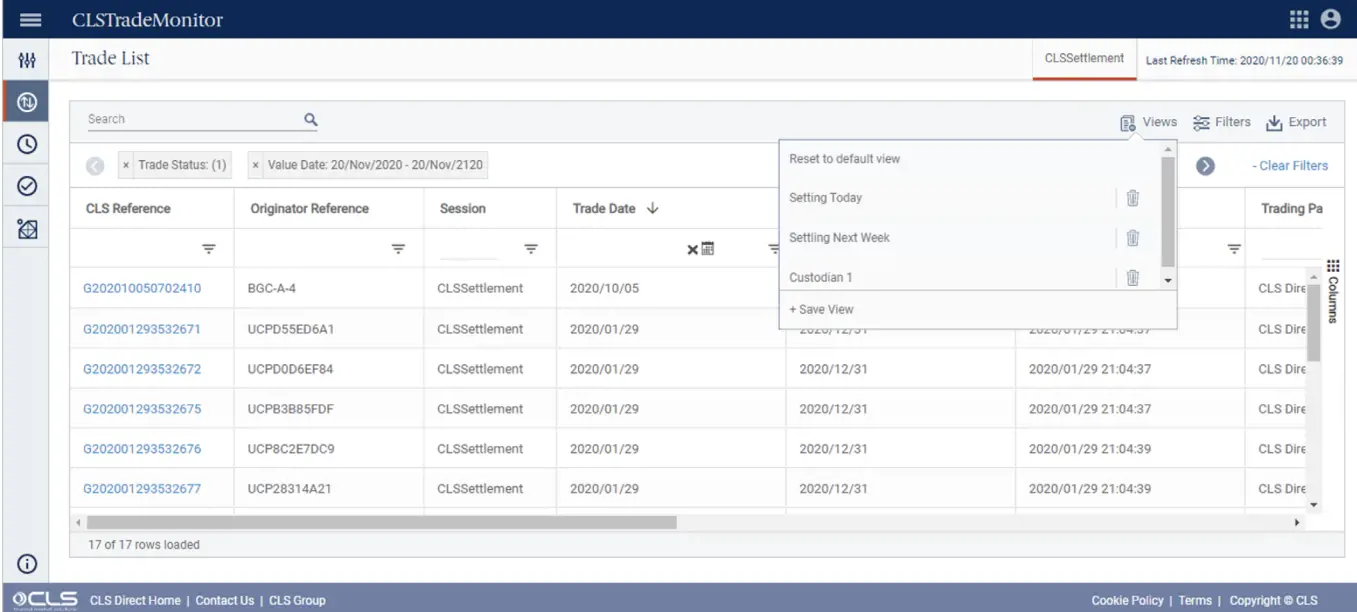

- Get a clear perspective of trade status through a consolidated view of all your trade instructions submitted to CLS across all your CLS products, custodians and counterparties

- Ensure early issue detection and resolution through near real-time trade status update of all details and timelines to investigate and resolve trade breaks

- Improve operational efficiencies with built-in-data filters and sorting functionality to help customize your historic data for reporting, auditing and analytical purposes by simply exporting to your trade management systems

- Customize and automate your workflow – receive post-trade status updates over a secure, platform-agnostic API or a simple web user interface enabling global remote access with seamless integration into your systems

Get the complete picture

We are pleased to offer CLSTradeMonitor with CLSNet as a combined value-add offering. We recognize that the cost of settling non-CLS currencies is higher than for CLS currencies.The combined solution allows you to drive operational process efficiencies, such as optimizing intraday liquidity, enabling real-time awareness of currency and counterparty exposures, and reducing operational and credit risk.

This powerful solution set enables you to access a holistic view of all your FX trades – multilateral and bilateral – for optimal post-trade efficiency.

Potential market use cases

Trade and settlement operations:

- Optimally monitor all trades up to settlement date, identify trade breaks, take remedial action and facilitate timely settlement

- Consolidate your interactions with CLS providers into one view

- Improve your post-trade reporting efficiencies.

CLSTrademonitor is also available through a partner application, TradeNeXusSM

FX Global code

Using CLS products and services plays an integral part in helping you comply with the FX Global Code.