FX Volume

Quality, executed trade volume data to enhance your trading models, support post-trade analysis and reporting and strengthen investment and research analysis.

Our FX volume dataset is available for spot, swap and outright forward FX instruments, offering an unparalleled view of the market across detailed tenors to help you improve your understanding of liquidity fluctuations and risk positions.

FX Volume improves:

- Trading models & strategies

- Trading algorithms

- Intraday liquidity risk management

- Research & alpha generation analysis

- Post-trade analysis

FX Volume reduces:

- Operational risk

- Currency risk exposure

- Trading risk

Benefits of FX Volume

By researching historical trends in global currency markets, you can gain a deeper understanding of their dynamic nature and improve various facets of trading performance – from building better liquidity strategies and analyzing trends across various timeframes to refining trading models, evaluating performance and developing new market analysis tools. Ultimately, this leads to reduced trading risk and sharper insights into market dynamics, supporting your business and trading models.

FX Volume insights around COVID-19

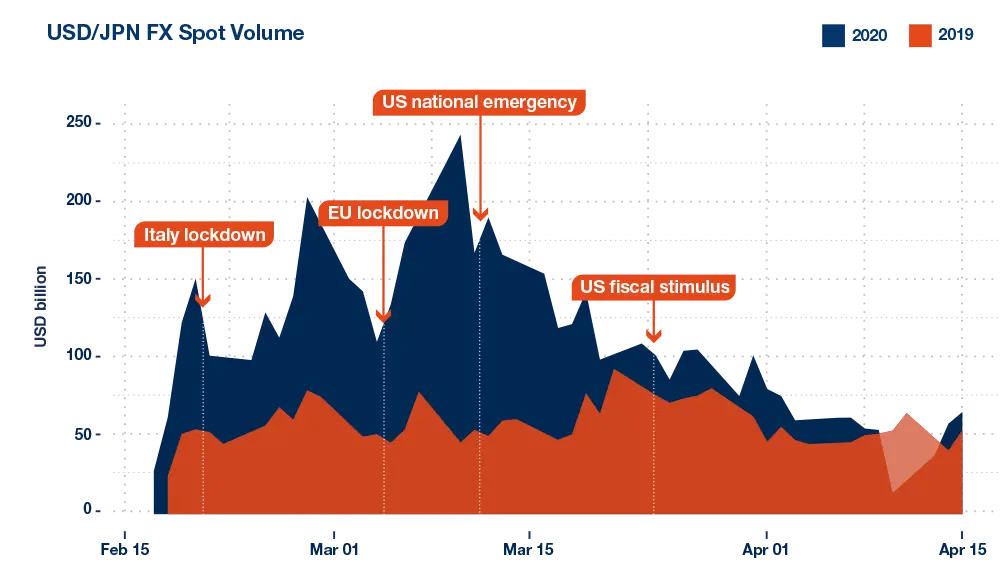

Coinciding with the COVID-19 related events between the Italian lockdown and the US stimulus announcements, we witnessed a significant volume surge across all FX instruments and currencies.

Our data shows that since the start of the European lockdown on 05 March 2020, USD/JPY spot volume increased significantly by USD201 billion compared to the same period in 2019.

USD/JPN FX Spot Volume YoY comparison