Cross currency swaps

Cross currency swaps trades have significant settlement risk exposure from the high value of the initial and final principal exchanges. In addition, settling these trades on a gross bilateral basis results in operational inefficiencies and liquidity constraints.

Our payment-versus-payment (PvP) settlement service

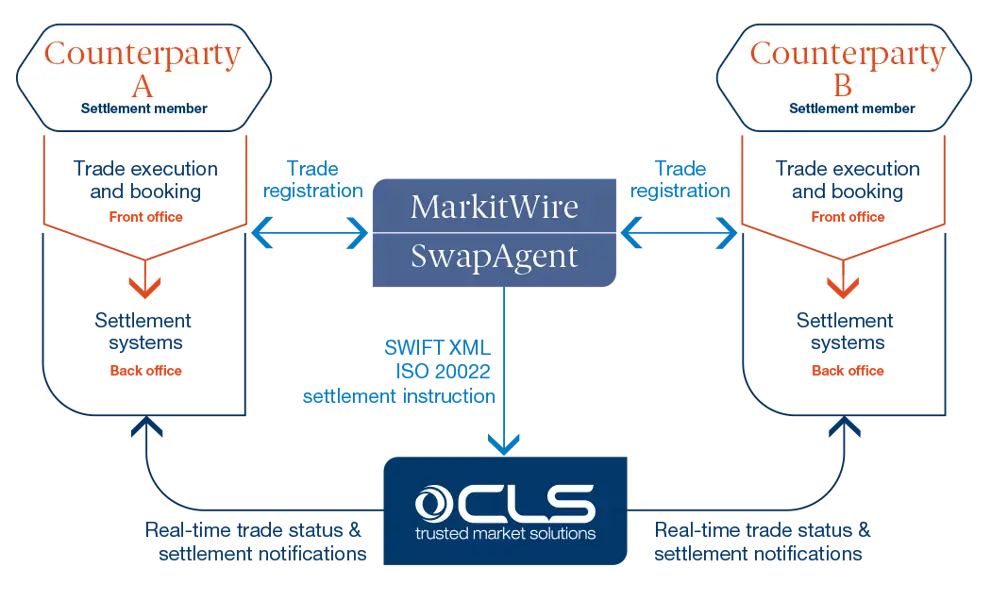

CLS settlement members can use our unique PvP settlement system and netting capabilities in conjunction with post-trade processing platforms – MarkitWire and SwapAgent – to mitigate FX settlement risk for cross currency swaps.

Mitigate settlement risk, while delivering operational and liquidity efficiencies for cross currency swap trades.

Improves

-

Operational efficiency

Reduces

- Liquidity and payment demand

- Settlement risk

- Funding costs for bilateral payments

FX Global Code

Supporting adherence to the FX Global Code through:

- Principle 35, settlement risk

Understand the process flow